Uncategorized

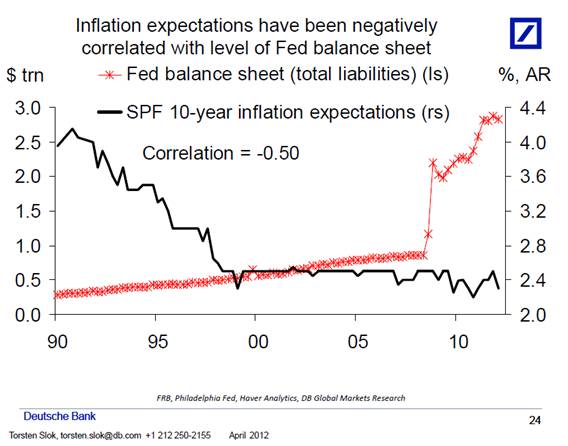

risk management in some cases

office view

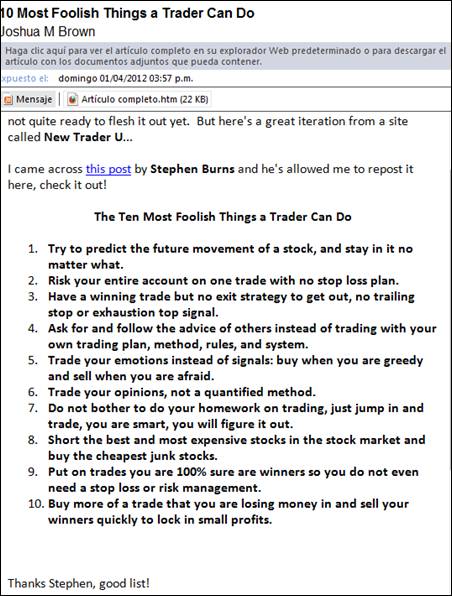

10 foolish trading attitudes | Via Reformed Broker

VaR calc

assesing some matters

Moral hazzard:

· Save the system, f* the bankers

· Save the bankers, f* the system

Bailout was about the 2nd, by a persuation of Dimon to Bernkanke.

You have to be clear that when you build and use a model, you are using a platonic shadow of reality.

Pretty much like the Simpsons chart in this blog.

Kahneman´s book has been very popular (thinking fast and slow), very smart people I have noticed are or have been reading it.

A banker is someone willing to lend you a umbrella un a sunny day, but when it is raining, you are too risky and do not qualify.

Pd.

This was an interview to Barry Ritholtz.

baseball

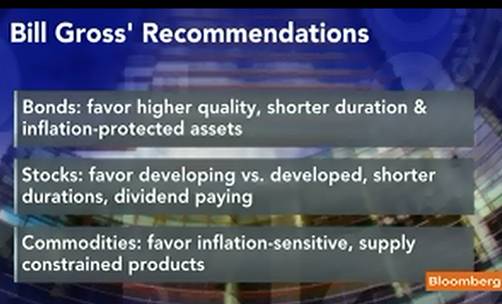

Bill Gross “free” Advice

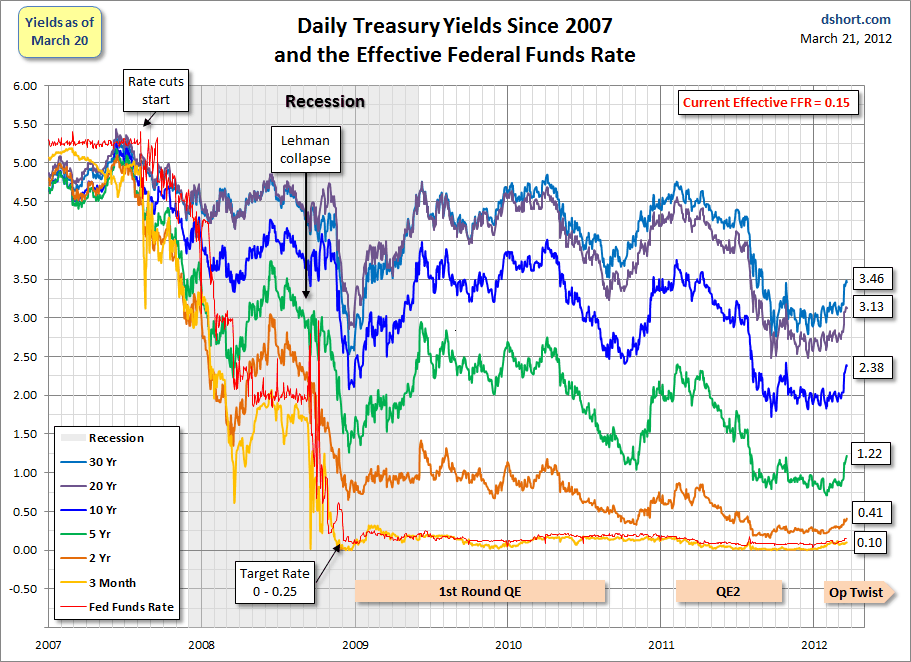

Treasury Yields

Caxton | ii magazine

Caxton group manages $9b with 200 workers with 2.% annual return for 2011.

Mr Law says that market strategies must be far more “micro” than using the four macro markets.

The review capital allocation every 6 months for each fund (25 overall).

Their drawdown rule used to be 10%, but now it is 5%. When a fund manager has a 5% drawdown, he must leave markets by two or five days. For this rule they manage a leverage of 2.5 to 3.5. they expect every fund to hit this drawdown limit at least every 18 months; if one fund does not hit such rule in that time it probably means that lesser risk is being taken by that fund or the manager is too much of a cautious approach.