Travel and Leisure

Billions —netflix

Aetna, MXNUSD, commerzbank

Money Never Sleeps — neither do newborns

Café: saludo uno

Leche: -50%

gringos mercantilistas. #Expoliación.

Como capitalino soy haragán

Aqui hay dos pantallazos de Google maps. Uno de NY y otro de Guate.

Yotel es un hotel en NYC ubicado en la 10 avenida y 42. La estación del metro mas cercana que va en dirección al Yankee Stadium está a kilometro y medio caminando, frente Bryant Park. Una caminata de 10 o 15 minutos, casi no se sienten.

En el otro pantallazo está la distancia entre la calzada Aguilar Batres, estación Mariscal del Transmetro, y el Periferico. Este tramo es conocido como la trece calle de la zona 11.

Nadie se atrevería a caminar a solas la trece calle a cualquier hora. De hecho a las horas pico hay Bici-taxis que cobran Q30 por ir al periferico/carabanchel.

Ah, pero si uno va NY lo mas prudente sería caminar esta distancia relativamente corta─ sobre todo por el tráfico y lo caro de hacerlo en carro/taxi/uber.

Esto lo descubrí una vez, a las 7pm, que me bajé del Transmetro y no conseguí como llegar a mi casa. Tuve que caminar (ahuevado). Medí el tiempo que me tomaría y resultaron quince minutos exactos. Me pareció poco (sobre todo pq camino lento) así que hice la siguiente comparación en Google maps y descubrí por qué soy tercermundista y huevón:

Como comentario final, siempre veo gente en caminando en la 13 calle con su smartphone y audifonos puestos. No estoy diciendo que no sea peligroso pero si fueramos mas urbanos quizás podríamos bajarle al gasto de gimnasios y no usar tanto el carro.

All models are wrong, but some are useful

Notes from interview to Emmanuel Derman by Barry Ritholtz:

- Born in south Africa

- Quant finance / models

- Models for describing business ─ securities: bonds, stocks, etc

- Transition from particles to human biases within financial markets

- You set on people

- All models are wrong, but some are useful

- How Soros and his reflexivity relates to financial models

- Some models don’t take reflexivity

- You have to accept that when building a model, you are short volatility, meaning that if the world changes you may lose

- Is this because LTCM failed?

- They were looking for very small deviations

- They were buying a lot of iliquid assets and leverage like crazy

- Models behaving badly

- Models seems to him like analogy

- Sleep is the interest we have to pay on the capital which is cold in the death, and the more regularly the interest is paid the date of redemption is postponed.

- You are borrowing your life from darkness and you have to pay it all way back at end.

- Economists don’t understand the difference between a model and a theory. A metaphor and an accurate description and physicist understand it very well.

- Models seems to him like analogy

- On the bail out

- If investors were given a put (the bail out) they should have received a call

- Quants were useful idiots

- You were a support not a position holder

- 1999: GS went public

- Got more bureaucratic

- It’s hard to translate an intuition to a number

- How much pay for an OTM option?

- How does one should modify a model?

- In GS, when analyzing derivatives exposures, a model builder was obliged to provide the assumptions and conditions behind the model

- When having results outside of normal results

- 1996 wrote an article on model risk

- Crisis 2007/2008 how much on models?

- Interest rates were very low and all were stretched for yield

- Rating agencies helped to the idea of high yield with low risk

- Finance is like nutrition. People take a small amount of information and extrapolate it like crazy.

- EMH: it’s not a theory. Markets are inefficient. It’s not a true fact.

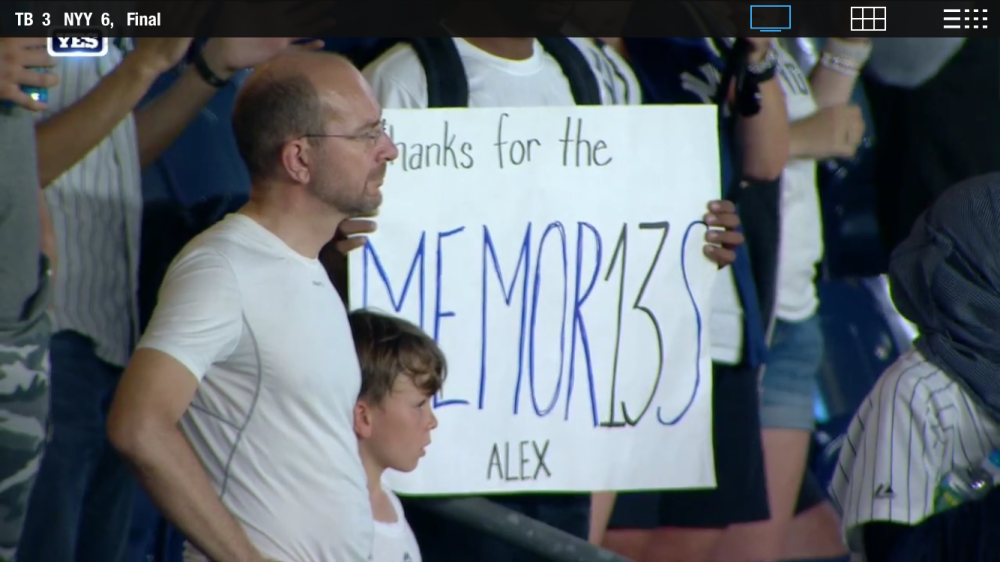

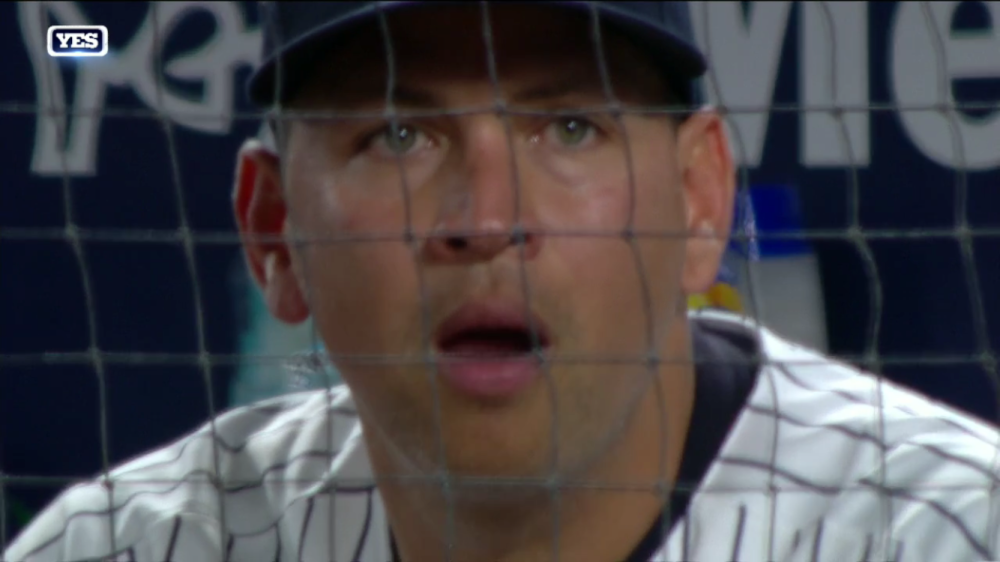

bye Arod

Bonos Guate

Del 11 de Agosto 2015 al 11 Agosto 2016 los bonos de Guatemala subieron 4.9% mientras que el indicador de bonos de mercados emergentes (embi) ha subido 6.5%.

Metodología:

Los bonos de Guatemala disponibles en los mercados de deuda son:

| Security | B Px | A Px | B YTM | A YTM | B ZSpd | A ZSpd | B GSpd | A GSpd | S&P | ||||

| GUATEM 5¾ 22 | 113.00 | – | 114.00 | 3.27 | / | 3.10 | 210 | / | 193 | 207 | / | 189 | BB |

| GUATEM 4½ 26 | 105.25 | – | 106.25 | 3.85 | / | 3.73 | 248 | / | 236 | 234 | / | 222 | BB |

| GUATEM 4⅞ 28 | 109.25 | – | 110.25 | 3.87 | / | 3.77 | 243 | / | 233 | 229 | / | 219 | BB |

| GUATEM 8⅛ 34 | 132.50 | – | 134.50 | 5.31 | / | 5.17 | 375 | / | 361 | 349 | / | 335 | BB |

En base a lo anterior se construye un índice calculando el precio y yield promedio para todos los bonos ponderados por el tamaño de cada emision.

Info del EMBI: iShares JPMorgan $ Emerging Markets Bond Fund is an exchange traded fund (ETF) that aims to track the performance of the JP Morgan Emerging Markets Bond Index Global Core Index as closely as possible. The ETF invests in physical index securities. The JP Morgan Emerging Markets Bond Index Global Core Index offers exposure to US Dollar denominated sovereign and quasi-sovereign bonds from Emerging Markets countries. Only bonds with a minimum remaining time to maturity of two and a half years at inclusion and a minimum amount outstanding of $500 million are included in the index. iShares ETFs are funds managed by BlackRock. They are transparent, cost-efficient, liquid vehicles that trade on stock exchanges like normal securities. iShares ETFs offer flexible and easy access to a wide range of markets and asset classes. Fuente: http://finance.yahoo.com/quote/IEMB.MI?p=IEMB.MI

¿Qué conclusiones se pueden hacer con esta info?

- Los inversionistas en busca de buenas tasas han tenido que arrimarse a los mercados emergentes para cumplir sus mandatos de inversión.

- Quizás el principal riesgo es liquidez

- Los Guates son tomadores de precio de las condiciones del resto de mercados emergentes.

- ¿A qué se debe ese gap de 1.5% entre los guates y sus compañeros emergentes?