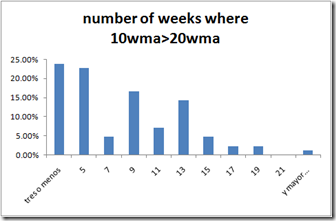

It has been nine straight weeks that this future has reported ten week moving average above the 20w ma.

Since 1983

So that the probability of this market to continue marking this pattern is 40%.

There are two times where this continuation was 19 weeks: the first time was from September 26 of 1986 to Feb 13 of 1987. The second time was twenty years later starting from Sept 14th of 2007 to January 18th of 2008. In the second one price went from 74 to 93 and in the first went from 14.12 to 16.39, 25% and 16% respectively.

CHECKING STRATEGIES: result: negative

Now in the nine week extension there are four samples:

using 2% stoploss

Sample one

27V89 to 22Z89

price return: +7%

strategy: +1%

Sample two

26H99 to 28K99

price return: +15%

strategy: -1%

Sample three

16U05 to 11X05

price return: -11%

strategy: -6%

Sample four

17J09 to 12M09

price return: +37%

strategy: +34%

The +34% return is more of a random result.